Homeowner Solar Investment Tax Credit

Residential Investment Tax Credit (ITC)

The solar energy credit is a tax credit that can be claimed against federal income taxes owed for a percentage of the cost of your solar system.

Overview

There are financial incentives for investment in renewable energy or energy efficiency for homeowners, though they vary from state to state and from year to year, depending on actions taken by the U.S. Congress or state legislatures.

In addition to leading to greater environmental benefits, these incentives make the investments more attractive to owners and investors by reducing out-of-pocket expenses, tax obligations, and the payback period (the period of time it takes to recover the upfront cost of purchasing a solar system).

In short, homeowners can make their energy costs lower over the long term by taking advantage of these incentives.

What is a tax credit?

In general, a tax credit is a dollar-for-dollar reduction in the amount of income tax you would otherwise owe.

The federal residential solar energy credit is a tax credit that can be claimed against federal income taxes owed for a percentage of the cost of your solar photovoltaic system.

Some Habitat homeowners may be eligible to receive the solar investment tax credit. This credit allows the homeowner to reduce their federal income taxes by 26% (currently) of the cost of the solar system. For example, if the solar system cost is $10,000, the homeowner can reduce their federal income taxes owed by $2,600, resulting in a net cost of $7,400. These savings are in addition to reduction or elimination of the monthly electricity costs and the proceeds from selling the Solar Renewable Energy Credits (SRECs) earned by their systems. Additional information regarding SRECS can be found here.

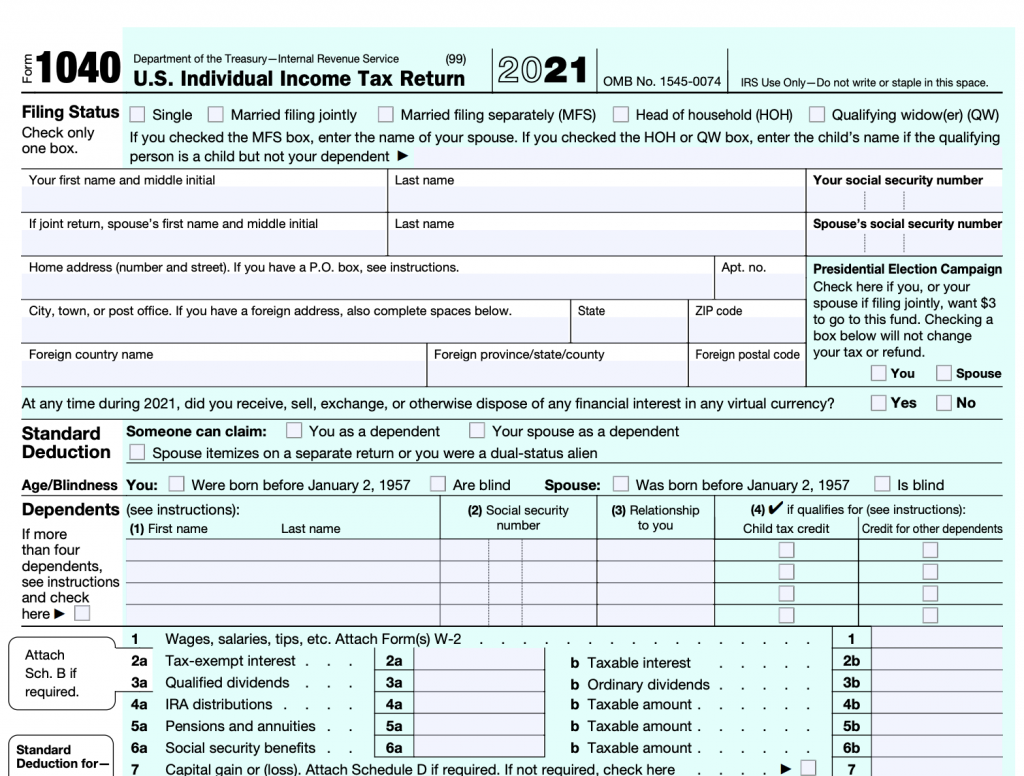

How to claim the Federal Solar ITCs

This tax credit is not fully refundable like other tax credits if you do not have enough tax liability to fully take advantage of the tax credit. Any unused amount of tax credit can be carried forward to the next tax year.

More info can be found at: solarreviews.com/blog/guide-to-claim-the-itc.

There may be other incentives that can be claimed for your solar system or energy efficient investments.

- Rebate from your electric utility to install solar

- Rebate from your state government

- State tax credit

Some of the energy efficient investment incentives may have income thresholds for eligibility. For current information, contact your nearest LEAP office.

For more information, visit the DSIRE database for current information about the residential investment tax credit (ITC) and other incentives.

Disclaimer

The solar investment tax credit and other financial incentives vary from year to year depending on actions by the U.S. Congress or state legislatures. Please check with an income tax professional to find the current tax credit rate and learn how to apply it to your tax return or the potential use of other financial incentives. The information on this page should not be considered professional tax or investment advice for your decisions.

More Resources for Homeowners